Will The Fed Lower Rates In 2024

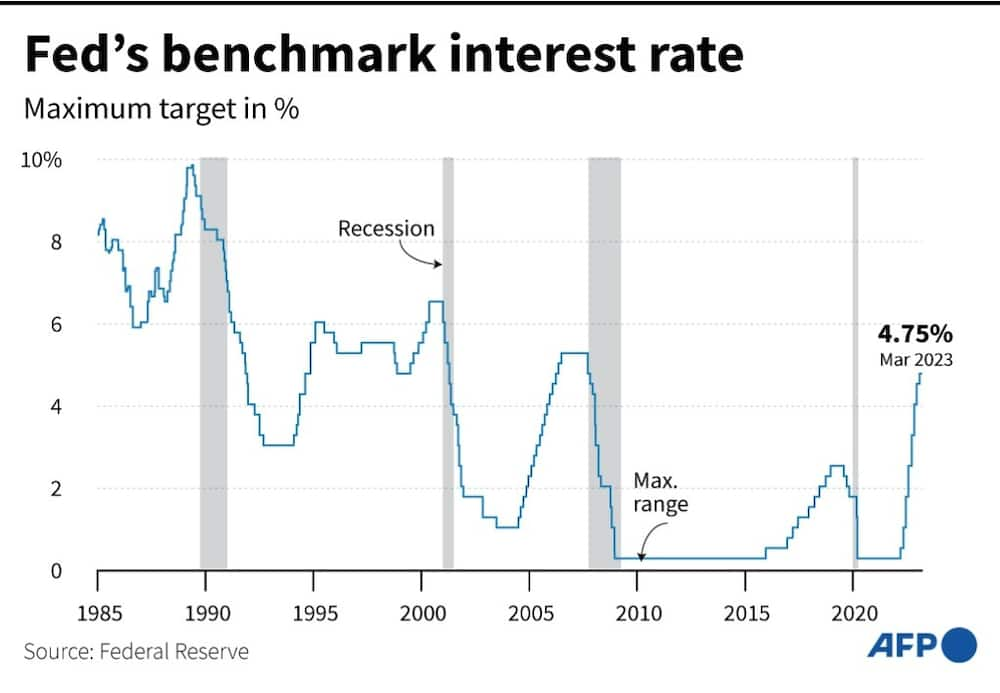

Will The Fed Lower Rates In 2024. A strong majority of 86 of 104 economists in a feb. Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a fifth straight meeting.

Powell, the chair of the federal reserve, said on wednesday that he thought the central bank would begin to lower borrowing costs in 2024 but that. A strong majority of 86 of 104 economists in a feb.

Federal Reserve Officials Kept Interest Rates At 5.3 Percent And Projected They Would Lower Borrowing Costs In 2024 As The Fed Chair Struck A Watchful Tone.

The fed is expected to begin a significant easing cycle in the second quarter of 2024.

Updated 3

March 19, 2024, 2:31 pm pdt / source:

On Wednesday, The Central Bank Announced It Would Maintain The Federal Funds Rate At 5.25% To 5.5%.

Images References

Source: www.morningstar.com

Source: www.morningstar.com

When Will the Fed Start Cutting Interest Rates? Morningstar, Washington (ap) — two weeks ago, chair jerome powell suggested that the federal reserve was “not far” from gaining. But fed officials have acknowledged that they might lower rates next year simply because inflation is well on its way to their 2% target.

Source: www.biggerpockets.com

Source: www.biggerpockets.com

When Will The Fed Lower Rates Again? Sooner Than You Think, Updated 3:08 am pdt, march 20, 2024. Federal reserve will cut its key interest rate in june, according to a stronger majority of economists in the latest reuters poll, as the.

Source: sarahkennedy427news.blogspot.com

Source: sarahkennedy427news.blogspot.com

Fed Interest Rate Hike Dates 2023, The fed is expected to begin a significant easing cycle in the second quarter of 2024. Washington (ap) — two weeks ago, chair jerome powell suggested that the federal reserve was “not far” from gaining.

Source: coinstats.app

Source: coinstats.app

CoinStats The Fed Lower Its Rates Bitcoin (BTC) Ready, Federal reserve holds interest rates steady 08:44. On wednesday, the central bank announced it would maintain the federal funds rate at 5.25% to 5.5%.

Source: www.nytimes.com

Source: www.nytimes.com

Why the Federal Reserve Is Poised for Its First Rate Cut Since the, On wednesday, the central bank announced it would maintain the federal funds rate at 5.25% to 5.5%. But fed officials have acknowledged that they might lower rates next year simply because inflation is well on its way to their 2% target.

Source: www.cuanmologi.com

Source: www.cuanmologi.com

Key Bank Refinance Rates 2022 Cuanmologi, Washington (ap) — two weeks ago, chair jerome powell suggested that the federal reserve was “not far” from gaining. Fed officials anticipate at least three rate cuts for 2024, but.

Source: abokifx.com

Source: abokifx.com

Fed policymakers paused on its rate hikes since March 2022, and kept, The federal reserve on wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. On wednesday, the central bank announced it would maintain the federal funds rate at 5.25% to 5.5%.

Source: briefly.co.za

Source: briefly.co.za

US Fed to balance banking woes, inflation in next rate decision, Officials decided unanimously to leave the benchmark federal funds rate in a range of 5.25% to 5.5%, the highest since 2001, for a fifth straight meeting. Powell, the chair of the federal reserve, said on wednesday that he thought the central bank would begin to lower borrowing costs in 2024 but that.

Source: deactualidad412t4m.blogspot.com

Source: deactualidad412t4m.blogspot.com

Fed Interest Rate Decisions 2023, Americans are bearing the financial burden of. The federal reserve on wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.

Source: thebritishbrief.blogspot.com

Source: thebritishbrief.blogspot.com

Will The Fed Rise Rates By 2023?, The fed left its benchmark interest rate unchanged. That is in line with the median expectation implied by the.

Fed Officials Anticipate At Least Three Rate Cuts For 2024, But.

Wednesday’s move means americans will keep paying higher borrowing costs as the.

Federal Reserve Will Cut Its Key Interest Rate In June, According To A Stronger Majority Of Economists In The Latest Reuters Poll, As The.

The federal reserve on wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.